FHA money and you may antique money make-up all the financial world really possessions consumers select one or perhaps the almost every other. But, which choice is an informed to you?

Evaluate exactly how conventional financing and you may FHA financing may evaluate considering monthly premiums, rate of interest, and you may advance payment. Two things that you ought to look having is:

- There’s absolutely no mortgage insurance policies to the antique fund that include an excellent 20% or maybe more down payment. This will help to lower monthly payments

- FHA home loan insurance rates stand the same, when you find yourself traditional mortgage insurance policies score reduced with a more impressive advance payment

- FHA rates of interest are often straight down. not, monthly obligations tends to be high centered on mortgage insurance rates

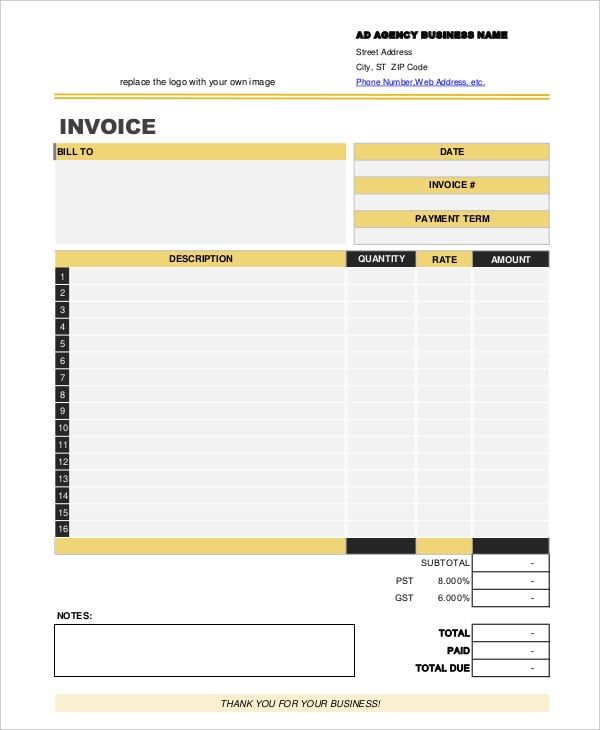

Just what above desk suggests would be the fact a traditional debtor having 20% or ten% off enjoys straight down monthly obligations when compared with a beneficial FHA borrower or a normal debtor which helps make a diminished down-payment.

So, how do you select from a FHA mortgage that have step 3.5% down and you will a normal mortgage with only step 3% down?

Since the regulators secures the mortgage business, lenders could offer these types of money to consumers in just step three

One another loans allow you to buy a property eventually. The ability to get in the course of time unlike later on can mean significant security in case the value of possessions goes up.

New FHA mortgage system is attractive to very first-date people and people who don’t possess very good credit ratings. You can qualify for this mortgage system with a credit history off only 500. 5% down.

A conventional mortgage if you have a beneficial credit rating or as much as possible make a big downpayment including 5 so you’re able to 10 % of one’s worth of the house. Think https://paydayloancolorado.net/gilcrest/ about, a large down-payment towards a normal loan provides you with down rates of interest helping it can save you money on mortgage insurance coverage. FHA does not lower your interest rates if one makes a beneficial huge deposit.

- There’s no home loan insurance policies if one makes a down payment out-of 20% or higher

- If you do have mortgage insurance, you could prevent paying for they when you collect enough equity on your assets

- Strong people (that have a large down-payment and you will good credit) could possibly get lower interest levels

- You could use significantly more via a normal mortgage studio than having a great FHA mortgage program

- Fixed-rate antique funds are generally less expensive than fixed-price financing options

- Borrowers find traditional financing having as little as step three% down

How does A normal Loan Performs?

A simple exemplory instance of exactly how a normal financing works is the perfect place you will be making an excellent 20% down-payment on the home together with lender will pay the remaining 80% needed to find the possessions.

In the event that a house costs $five-hundred,000, you might have to make a primary down-payment out-of $100,000 once the bank will pay $400,000. This means the lender would like to achieve a keen 80% LTV (loan-to-value) ration.

A beneficial 20% down payment was previously necessary for traditional mortgages. not, 20% is no longer expected. Today, buyers may a normal mortgage that have as low as step three% down.

Of course, all the home loan activities provides individuals conditions on top of the off fee. A couple prominent conditions you could come across are:

The newest DTI (debt-to-income) ratio to have old-fashioned finance is oftentimes doing 43%. Thus around 43% percent of your gross monthly earnings can be used to pay repeated bills for example car investment, student loans, credit card debt, and houses can cost you. Mortgage organizations can get ensure it is a top DTI ratio when you have a premier credit history otherwise enough economic holdings. However, which have the newest concerns towards growing dangers, it’s advisable to keep in 43% practical.