Creative capital measures may well not meet up with the VA’s conditions having loan assumption, possibly restricting the latest feasibility in the option

Veterans Items (VA) finance commonly need no advance payment otherwise personal mortgage insurance rates (PMI), leading them to an attractive choice for next domestic orders. If starting a different sort of primary quarters otherwise generating local rental earnings, we’ll let show you from the qualification requirements, entitlement utilize, and other considerations to really make the the majority of your Va mortgage. Creative TC LLC (Innovative Deal Asking) understands the unique means regarding experts and supply nationwide selection. In this article, we’ll talk about just how Virtual assistant fund can help you to get another family, the possibility expenses associated with attempting to sell a property with little to help you no collateral, and how we can help in reaching your houses and you can financial support requirements.

An extra household can be utilized given that a rental assets, whether or not one residential property must be a first house in order to meet Va occupancy requirements. Qualifications to have good Virtual assistant financing relates to meeting particular armed forces provider conditions , w hich are affirmed by the a certificate from Qualification (COE) that also verifies entitlement . Th is certificate can be acquired regarding Va site or a professional Va associate/endorse . The fresh new Virtual assistant mortgage program try versatile, but loan providers usually nonetheless determine creditworthiness and you will earnings stability. Even if particular credit score conditions can vary, it is advantageous to enjoys a relatively a good credit score records.

Entitlement refers to the restriction loan amount guaranteed by Virtual assistant as opposed to demanding an advance payment, and that is normally recovered in the event that financing was reduced. Which matter varies according to multiple issues, as well as service record and you can used Va financing professionals. Virtual assistant financing restrictions differ by the state while your neighborhood loan matter try exceeded, a deposit may be required based on a portion from the essential difference between the price as well as the loan limit. Using imaginative money into a house acquired with good Virtual assistant mortgage doesn’t constantly feeling Virtual assistant entitlement actually. Yet not, innovative capital arrangements will get cover alterations in control or financing terms, that’ll indirectly apply at entitlement.

In some instances, good Va loan can be assumable, making it possible for a unique client to take along side present financing having fun with their own resource. Although not, delivering an effective Va financing with creative money actions (eg susceptible to otherwise supplier finance) you will definitely prove difficult. Virtual assistant funds typically prefer which to get done with a professional experienced and you can an eligible buyer, though this is simply not a requirement.

The objective of creative financing is always to aid homeowners with little so you can no collateral inside their assets, along with other activities eg delinquent mortgage repayments restricting new home owners offering options. Having virtually no guarantee can be perspective financial challenges getting property owners. Traditional promoting strategies have a tendency to cover individuals expenses, also agent commissions, settlement costs, fixes, and selling charge. When you find yourself in cases like this, check out the pursuing the affairs:

Financial Effects: Limited security can be a deterrent to help you providers as it could connect with its entitlement and you will bring about out-of-wallet expenses. It’s important to evaluate the money you owe and you can see the potential costs associated with attempting to sell before generally making people final behavior, specially when the vendor is searching for its entitlement recovered.

Choice i can’t believe people go vacation with loan Possibilities: Our organization specializes in to purchase properties all over the country, giving a publicity-100 % free choice to people facing little to no collateral. Attempting to sell so you can united states in person can avoid the standard attempting to sell procedure and you will cure certain, if not completely, of your own associated financial burden.

Imaginative TC was committed to assisting you for the reaching your own property and you can investment requirements. There are many complexities and you will possible implications of utilizing creative financial support toward property gotten having a beneficial Virtual assistant financing. We could assist assess your specific situation, render recommendations, which help effortlessly navigate the method. Remember that all of the disease is different, together with usefulness from imaginative money methods may vary depending on the particular terms of the latest Va mortgage, lender regulations, and you can regional guidelines. Talking to a great Va loan pro, a talented financial, otherwise a real house attorneys helps you see the legal effects and also make advised conclusion.

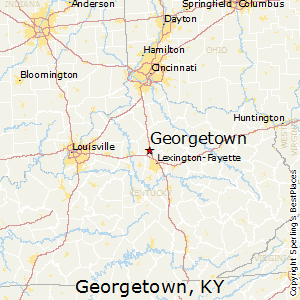

All over the country Home Buying: I pick house all over the country, delivering a convenient and you may successful services to own home owners trying to sell easily and you may trouble-100 % free. We know the unique factors with the Va financing and offer a sleek processes customized toward book means.

Services: We provide custom meetings to discuss the choices and you will browse the causes for selecting or promoting property. All of our positives are well-versed inside the Va fund and can offer advice specific on the situation.

Request a deal: If you’re considering selling your current domestic, demand an offer out-of all of us! We usually take a look at your property and provide you that have a good fair, no-obligation offer, enabling you to make the best choice.

A house funded with a good Va financing is usually expected to feel a first residence

By the leverage the key benefits of a Va financing, you could potentially obtain a moment house, even with little to no guarantee. Whether you choose to expose a unique top house or make rental earnings, knowing the eligibility conditions, entitlement use, and you can prospective factors is crucial. Imaginative TC focuses on enabling veterans navigate the reasons out-of Va money and offer across the country solutions customized with the particular need, whilst maintaining appropriate Virtual assistant assistance and guidelines. Grab the next step towards your housing and you will financial support specifications from the setting up an appointment with the educated class otherwise request an offer on your own latest home and find out a stress-totally free alternative to conventional attempting to sell and you can financing procedures. Why don’t we become your mate into the promoting your entitlement and having your homes and you may capital specifications!