It’s surprise to learn that taking onto the construction hierarchy is still demonstrating are difficult for almost all create-feel basic-big date buyers. We now have read before that the Financial off Mum and you will Father seems becoming an excellent supply of loans getting specific consumers. not, previous records suggest men and women looking to purchase its basic assets was seeking expanded mortgage loan episodes, as well.

Numbers found in the Mortgage broker Ltd demonstrate that the quantity of individuals taking out fully a Uk mortgage over good 35-seasons identity possess doubled into the prominence over the past 10 years. In the past, just 11% off customers contained in this category plumped for an expression so it a lot of time. Today, it has trebled in order to 33.2% regarding basic-big date consumers.

The typical home loan identity has enhanced

A 25-season home loan term used to be the high quality duration of home loan extremely buyers manage pick. It has today altered therefore the average title is just about twenty seven ages. With many different the new customers searching for challenging to track down a good package, you to clear choice is to increase the life span of your mortgage alone.

The fresh new development is additionally seen in the huge lose regarding part of users that selected the greater number of-familiar twenty-five-season name. A decade ago, 59% out of customers selected you to definitely mortgage term, whereas this present year keeps viewed which figure get rid of in order to 21%.

Even more manageable monthly installments

Most people comprehend the 35-year home loan months since an easily accessible solution to get rid of the monthly installments, told you Darren Pescod, Chief executive officer of your own Large financial company Restricted. Sometimes, it may make difference in having the ability to easily manage paying the mortgage otherwise wanting challenging making those costs.

With many demands facing young adults obtaining onto the homes steps, it’s easy to understand why many are tempted to like a longer percentage name. But not, it does imply particular are still investing their financial into the advancing years, based once they remove it.

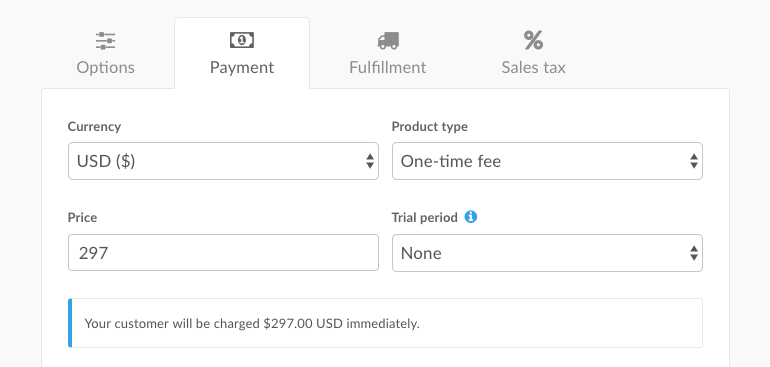

The latest graph below reveals the month-to-month rates centered on a good ?two hundred,000 cost financial with a presumed rate of interest away from dos.5%.

Perhaps you have realized in the above, the real difference in https://paydayloancolorado.net/hartman/ expense regarding a twenty-five-seasons financial title at the ?897 four weeks than the thirty-five-year financial title during the ?715 monthly is a change of ?182 a month.

The essential difference between a home loan out of thirty-five years and something of forty years, yet not, is ?55 per month. Its for this reason that individuals recommend that readers always make this review and try to keep the quickest financial title possible that is actually affordable to you personally.Amount to acquire (?)Term (Years)Attract (%) Calculate

All the industries Need to be numeric, thus ?375,000 was 375000? /moPlease Notice: These types of rates is actually to own illistrative motives only, and may even disagree based on their indivial situations.

However, a caution regarding the overall payment count

Not simply does the fresh new offered mortgage identity suggest the conclusion day try forced after that back, it also means the entire matter repaid is significantly huge. One example indicated a beneficial ?150,000 financial bought out thirty-five age unlike 25 years create end up being ?137 minimal four weeks, offered mortgage loan off dos.5%.

Yet not, the entire installment do sprout because of the more than ?23,000. In making the household budgeting convenient temporarily, individuals also are investing a great deal more over the long haul. Going for a home loan and ensuring that it is affordable is often will be an essential financial decision. This type of rates inform you just how true that is.

We could actually become viewing a different pattern towards the prolonged home loan terms. It is not easy to visualize consumers going for reduced home loan words in case your only way they’re able to rating on the casing ladder to start with is via an extended home loan title. The squeeze towards money is even prompting most people to appear within easing monthly home loan repayments. Until that it changes, it looks likely that good thirty-five-seasons mortgage name may become more common from the coming years.