Which are the Requirements having USDA possessions?

When you are in the market for property and seeking for reasonable possibilities. You’ve got heard about USDA-eligible homes for sale. USDA qualification makes reference to residential property which can be based in outlying areas and you can see certain criteria.

Here, we shall definition what a keen USDA eligible assets looks like. Where to find USDA virginia homes in your area? And you will which are the USDA financial requirements or any other extremely important factual statements about these types of financing applications?

Have you been thinking in the event the property near you qualifies just like the USDA eligible?

Basic, your house need to be situated in an area considered rural of the the latest USDA. The property need to be situated in an area appointed of the USDA due to the fact rural. Consequently it ought to be outside area limitations otherwise within discover areas determined by the firm.

How to know if your own wanted area qualifies as rural will be to see the USDA’s property eligibility chart. New USDA home loan chart you to definitely confirms new target out of a property is based in an excellent qualified city.

Just what condition does a property have to be in for a USDA-eligible Home loan?

Earliest, why don’t we look at exactly what position requirements for your home have to satisfy becoming considered eligible for a good USDA mortgage. In addition to being based in an eligible city, the fresh new house’s reputation need certainly to see particular requirements getting good USDA mortgage. According to the USDA, all the residential property need to be during the good condition and you will appraised towards price or even more.

In addition, your house might also want to see particular criteria off status; USDA Home loans need no biggest products found throughout the a check. They also suggest that all properties must have sufficient accessibility roads and you will resources like drinking water, sewer, and strength.

Exactly what are the criteria having USDA qualified assets?

It is essential to contemplate, too, one even if you look for an effective USDA Eligible household that fits most of the criteria had a need to discovered that it mortgage type. There is absolutely no make certain that the loan application are still acknowledged because of earnings restrictions otherwise amount borrowed. USDA loan providers will nevertheless consider applicants’ credit score, debt-to-money rates, or other aspects of the brand new creditworthiness away from a potential domestic buyer.

USDA mortgage is intended toward purchase of an initial quarters. This means that the property you are by using the loan so you’re able to get must be their permanent home, and not another domestic otherwise money spent Making it usually best to consult a specialist prior to committing excess amount for the procedure for to acquire a qualified house close by!

USDA funds need effort while looking for qualified residential property; yet not, they offer a opportunity for people who qualify as they give lowest-rates and you will charge compared to conventional mortgage loans which makes them well worth considering when buying possessions close by!

As entitled to a good USDA home loan, your income must not go beyond specific limitations lay from the USDA. The amount of money restrictions will vary of the place and you may household dimensions. Generally speaking, money limitation is founded on the new area’s average money and exactly how many anyone staying in the family.

To decide whenever you are eligible according to monthly earnings, you can examine brand new USDA’s earnings qualifications calculator on their site. Attempt to enter into your local area and quantity of people in your family, and the calculator will say to you for folks who meet with the earnings conditions getting a beneficial USDA financial.

Just remember that , the fresh USDA financial program is designed to assist low to reasonable-money some body and parents when you look at the rural parts go homeownership. If your income is actually high, you will possibly not be eligible for an excellent USDA financial, and also you s for example USDA or a traditional home loan.

Among the significant benefits of this method would be the fact they will not mandate a down payment. And USDA financing program do not have private mortgage insurance policies in their mortgage program reducing the monthly installments to own potential customers.

People can enjoy 100% resource, beginning doorways for many who possess encountered pressures raising the 1st finance for their dream domestic. Full, the newest USDA’s no downpayment coverage is actually an invaluable financing having those individuals selecting affordable houses options regarding rural areas of the loans for bad credit in Fairplay CO usa.

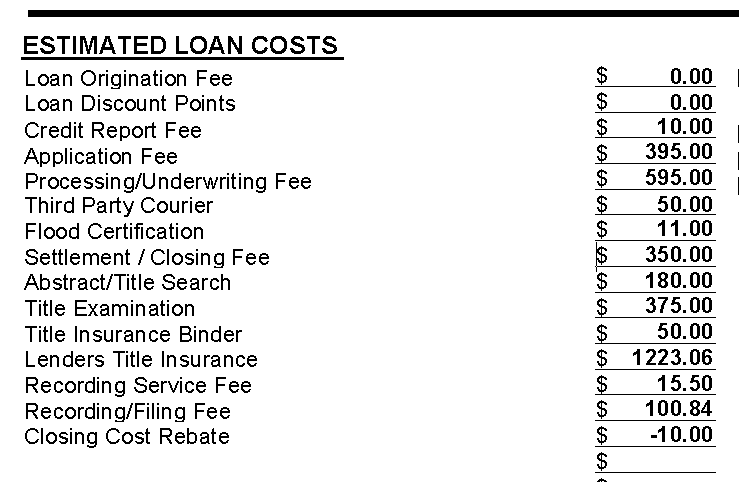

When it comes time order your domestic, understand that there are a few more conditions associated with the getting financing compliment of RHS (Rural Construction Provider), such earnings constraints and you will credit criteria-so make sure you discuss that it further with your financial in advance of to make any conclusion regarding the purchasing an eligible household. Not only that, make sure you remember throughout the most other costs associated with to invest in a home, such settlement costs, examination charges, label insurance premiums, and a lot more!

We hope this web site is useful in getting understanding of USDA-qualified homes for sale close by! With these info and you will resources, we hope in search of your ideal family was a breeze!