If you have had a moment domestic for a while, you have produced equity on assets lately. Just perhaps you have paid off the mortgage harmony over time, but the majority property have raised somewhat during the value. You could consider your 2nd home due to the fact a supply of money if you need to HELOC to own an enormous debts.

Residents who very own numerous home either wonder whether it’s better to borrow against the primary home otherwise its travel otherwise funding functions. We have found all you need to know about delivering a beneficial HELOC to the an extra household.

Can you take out good HELOC into second house?

Thankfully, you can easily take out a beneficial HELOC on the 2nd household. So long as you have enough equity throughout the assets and you may you see particular lender-certain criteria, the process is very similar to bringing an effective HELOC on your own number 1 household. Individuals can choose if or not they had will take-out a HELOC to their basic otherwise next household, as there are pros and cons to often choice.

How an effective HELOC with the 2nd family is different from basic home

The procedure of obtaining and making use of HELOCs into second property is similar with techniques to HELOCs towards first land. The biggest difference between the 2 would be the fact HELOCs into second property generally have stricter app requirements.

For both very first and you may 2nd domestic HELOCs, you really need to exit specific equity on the property untouched when you’re taking out the personal line of credit. However, of several loan providers want an increased amount of collateral in which to stay the home having the next house. Oftentimes, you will have to exit about twenty-five% security when you take out good HELOC with the the second house. Hence, locate a hefty line of credit, you will have to have significantly more than 25% for the guarantee.

The credit score conditions to own HELOCs on the next belongings could be highest, too. Of many lenders require at least credit score of 680 to 700 getting next house HELOCs. You also may have to individual our home to possess annually prior to a lender will accept you to your credit line.

When your 2nd home is a rental or money spent, the prerequisites for approval to own a HELOC is generally actually stricter. Leasing attributes was high-risk since you rely on somebody else’s money to pay for mortgage and other expenditures. In such cases, loan providers wish to be very sure that you will not standard toward payments. For a great HELOC into a residential property, lenders will wanted a credit rating off 720 in order to 740. You additionally must illustrate that you have enough dollars supplies to fund twelve to 1 . 5 years of payments.

Advantages out of taking out a good HELOC to the second home

There are a number of positive points to taking right out good HELOC to your a moment family if you like the latest credit line getting a major expenses. Specific property owners believe that HELOCs to your 2nd land is actually less risky than simply HELOCs with the top property. If you find yourself your first and 2nd belongings is both at the mercy of brand new exact same business conditions, your have confidence in your first home having a spot to alive. If you are shedding your second family are disastrous, the limits are not quite as large as they are to suit your basic home.

Good HELOC can be a preferable variety of credit over most other type of personal debt as you may sign up for loans as required. In the place of getting considering a lump sum, you could tap into the latest credit line whenever you need bucks. That it ensures that you aren’t credit more you would like, and it enables you to would the debt significantly more cautiously. HELOCs are specially perfect for domestic home improvements, tuition expense, and other enough time-term and you may repeating costs.

Disadvantages out-of taking right out a HELOC with the second home

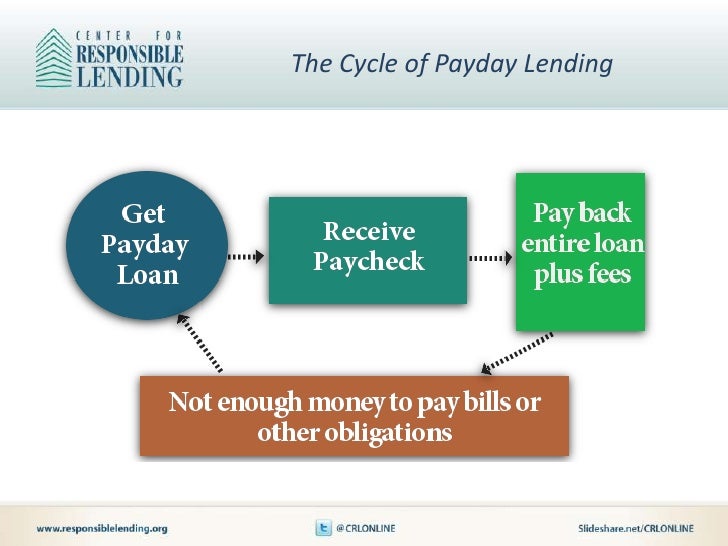

If you are a moment family HELOC might be a good choice for specific borrowers, there are even certain cons to keep in mind. HELOCs for the second residential property normally have highest interest rates than HELOCs towards first homes since next house was riskier to own loan providers. Will, next house’s financial is the basic percentage individuals have a tendency to forget whenever they struck an economic harsh area.

Defaulting in your HELOC payments as mark period concludes you https://paydayloancolorado.net/dove-valley/ will produce foreclosure. Whenever you are property foreclosure on the the second family isn’t as serious while the property foreclosure on your own first residence, will still be a very exhausting experience and you will a primary financial weight. You need to be completely sure if you could potentially repay the brand new HELOC whilst existence newest on each other the first and second residence’s mortgage loans.

Other borrowing alternatives

For those who hope to make use of their residence’s guarantee but don’t envision a beneficial HELOC is the best alternatives, you may have several comparable choice: property guarantee financing and a cash-aside re-finance. HELOCs and you may household security financing try superior to refinancing for individuals who have a decreased, repaired interest rate on your home loan. Refinancing to a higher rate of interest try hardly a good idea as you can put several thousand dollars over the lifespan off our home financing.

The primary difference in a house equity loan and you will a good HELOC is the fact a home equity loan is given just like the a swelling sum. By contrast, a good HELOC is actually a personal line of credit. An effective HELOC enjoys a variable interest, and you can a property equity financing usually has a fixed speed. Once you learn exactly how much you will want to obtain and you may like fixed, foreseeable payments, a home collateral loan could well be a much better alternative.

An earnings-away re-finance is a good options if prices are presently lower and also you should safe a far greater rate of interest in your home loan. Refinancing normally expand the brand new lifespan of the financing, even when, so you should believe refinancing to help you a great 15-seasons otherwise 20-12 months home loan.

Taking right out an effective HELOC on your own 2nd household will be an enthusiastic sophisticated way to availability your home guarantee. Although not, you must be cautious never to more-acquire and put oneself below financial filter systems. If you have questions otherwise concerns about 2nd family HELOCs or other types of borrowing from the bank, speak with home financing expert to obtain qualified advice in your disease.