Authorities service-recognized loan apps are fantastic options for very first-day homeowners or all the way down-earnings borrowers. USDA and you can FHA fund is actually both work at from the various other authorities agencies and certainly will end up being more straightforward to be eligible for than other traditional home loan apps.

When comparing USDA and FHA money, one is not really better than one other; the borrowed funds program that is right for your requirements depends on your own newest state. One another USDA and you may FHA mortgage finance promote multiple variations one make them attractive to earliest-date homeowners and reduced- so you’re able to reasonable-money individuals.

Because the a leading Kansas Urban area mortgage company, First Fidelis renders the fresh new financing techniques simple for your. The USDA and you can FHA finance are created to make property and you will refinancing a great deal more affordable. Here is what you have to know regarding FHA and you can USDA loans in the Kansas Town.

What is actually a great USDA Loan?

USDA fund are given from the personal loan providers and you may supported by the new U.S. Institution regarding Farming. Which have USDA finance, consumers have to fulfill specific income and place requirements mainly because fund are only open to men and women residing qualifying outlying communities.

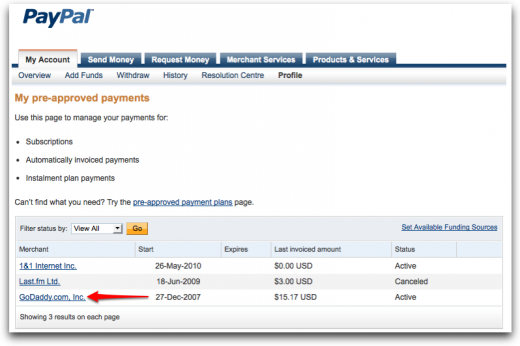

As procedure for delivering an effective USDA financing usually takes extended than an FHA financial, it is only because USDA fund need to be underwritten double. Generally, the lender have a tendency to underwrite the loan very first, then it will be underwritten again of the USDA. However, when you yourself have a credit score out of 640 or maybe more, the mortgage is actually immediately underwritten because of the USDA without extra time with it.

Benefits associated with a great USDA Mortgage

USDA family lenders could work along with you to find the finest loan program for your novel condition. An effective USDA loan also offers benefits in order to home buyers, including:

- No advance payment requirements

- Reduced home loan insurance and you can fees

- The seller will pay people closing costs

- Commonly cheaper than a keen FHA financing, both initial and future

- Lenders might not require you to possess bucks supplies so you’re able to secure people funding choice

- Zero credit limit; limit amount borrowed depends on your ability to settle

USDA Financing Qualification Requirements

USDA mortgages are meant to increase homeownership prices as well as the economies when you look at the rural areas. Therefore, you should reside in a qualified outlying city when planning on taking virtue of an excellent USDA loan. Your local area should also satisfy particular state assets qualifications standards.

USDA money possess almost every other qualifications standards too. Your credit rating have to be at the very least 640 or maybe more, and you need to have a fairly lower debt-to-money ratio-around fifty percent of one’s earnings otherwise less.

Eventually, USDA money provides rigid income level guidelines. These can are different according to the number of individuals in your family as well as the precise location of the domestic. In the event the income is more than 115 per cent of your own median money for the reason that town, you are ineligible and should not qualify for a USDA loan.

What is a keen FHA Financing?

An FHA home loan is backed by new Government Casing Government and you may given courtesy individual loan providers. Whenever you are an enthusiastic FHA financing techniques may take more time than just a good USDA loan, it has got enough flexibility for home buyers which have straight down credit ratings.

not, cash loans Columbus GA FHA mortgage requirements carry out indicate an optimum financing matter created in your area, it is therefore crucial that you remember this since you shop to own home.

Benefits of an enthusiastic FHA Financing

- Means a credit score out-of 580 or maybe more, therefore it is just the thing for those with straight down credit

- Zero earnings requirements or restrictions

- Large debt-to-income ratio anticipate

FHA Loan Qualifications Requirements

Only earliest-date homebuyers can be approved getting an enthusiastic FHA financing. This also comes with consumers whom haven’t had a home into the at the least 3 years.

While there are not any income standards getting FHA financing, you will need to show your earnings amount and feature you to definitely it is possible to make monthly home loan and you can insurance coverage money. FHA finance including allow for increased obligations-to-income ratio, particularly if you possess a higher credit score.

Whenever you are an initial-big date household visitors otherwise looking to re-finance, Very first Fidelis is here now to help. We offer our users USDA and FHA loan choice, very our expert lenders find suitable financing system to own your. Get started with our very own pre-approval app, otherwise contact us today at 913-205-9978.