Overall, Virtual assistant financing prequalification functions as a strategic step-in the house to acquire techniques, giving a very clear picture of your own borrowing capabilities and function you up for achievement. It is an easy yet effective unit that will notably impact the property feel, ensuring youre well-ready to accept the journey ahead.

Prequalifying having a Virtual assistant mortgage concerns several key measures that help you are aware your financial status and prepare for the mortgage process. These methods tend to be checking your credit score, event called for financial documents, and submission basic information so you can lenders. Each one of these procedures plays a vital role when you look at the guaranteeing a great easy and you may effective prequalification processes.

Look at the Credit score

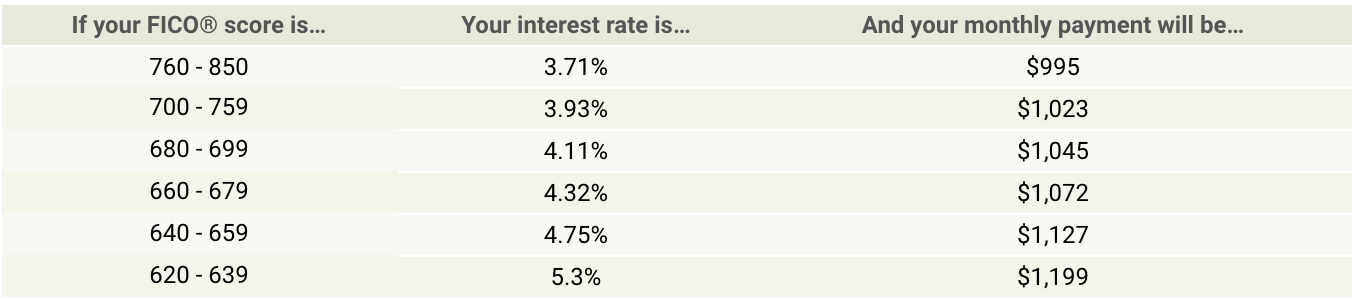

Reviewing your credit rating are a crucial initial step in the Virtual assistant loan prequalification procedure. Once the Va itself doesn’t always have a built-within the credit rating demands, very lenders generally speaking want at least FICO get regarding 620. From the examining your credit score early, you could potentially pick people factors or take measures to change they if necessary. So it proactive approach can help you safe most readily useful rates of interest and you will mortgage terminology.

You will need to keep in mind that the brand new prequalification credit assessment is frequently a smooth pull,’ which doesn’t perception your credit rating. But not, inside complete preapproval processes, a challenging borrowing from the bank inquiry may occur, which can some reduce your rating. Wisdom such nuances helps you manage your credit effectively and you will ensures you are really-available to the second steps in the fresh Virtual assistant loan procedure.

Assemble Economic Records

Gathering the necessary economic documents is an important part of one’s prequalification techniques. These documents promote loan providers that have an extensive look at your financial health, that’s crucial for choosing their qualifications and you may possible amount borrowed. Extremely important files were spend stubs, lender statements, and you will tax returns. Which have these types of data ready is also facilitate the prequalification process and also make they more beneficial.

Getting veterans and you will active military players, a lot more records instance information on retirement account can be requisite. Guaranteeing you really have all the requisite paperwork manageable not merely boosts the procedure in addition to helps you avoid any history-second hiccups that’ll reduce your loan recognition.

Fill in Very first Suggestions to Loan providers

Once you have seemed your credit score and you can attained all of the necessary economic records, together with your credit report, the next phase is add very first information so you can loan providers. Including factual statements about the a position, money, and you may big recurring debts for example vehicle money and student education https://paydayloancolorado.net/leadville/ loans. Getting this information helps loan providers assess debt health and influence your own eligibility getting good Va financing.

Distribution that it first info is a crucial part of the brand new prequalification processes, because lets lenders to provide you with a primary guess of loan amount you may also qualify for. This guess was invaluable having making plans for your house get and you will setting an authentic funds.

Va Loan Prequalification against. Preapproval

Understanding the difference in Va loan prequalification and you can preapproval is very important to own navigating the home to acquire processes efficiently. Prequalification is founded on every piece of information your provide to the financial institution and provide a primary imagine of your own loan amount you could potentially be eligible for. Its a low-joining action that will help you are aware your financial position and you can talk about the financial selection.

- Submission a formal mortgage app

- Getting comprehensive records, and a credit score assessment

- Going through a thorough breakdown of your own credit and you can economy

Preapproval letters routinely have a credibility age of 60 to 90 weeks and show sellers that you are a critical and financially licensed customer. Getting good preapproval letter was a crucial step up the home to find techniques because will provide you with an obvious understanding of your own to shop for electricity and assists you will be making aggressive also provides toward characteristics.