Dealers seeking influence its investment profile must ensure that it strategy suits their total financial goals, and endurance to possess risk.

Express

Borrowing money today to put money into the near future is actually a technique of many profitable buyers have used to-arrive its individual and you can financial specifications – be it to shop for a house, purchasing an education otherwise carrying out a business.

A less common, however, just as forward-looking strategy for specific, is actually borrowing to build an investment collection including stocks, securities and you will money financing.

Taking on financial obligation to help you safe assets may seem counterintuitive to a few although potential productivity is profitable in the event the over smartly, says Tony Maiorino, lead of one’s RBC Family Office Features people.

Credit is a thing somebody manage every day – for an automible, a house otherwise a vacation assets, states Maiorino. The question was, if you borrow to expend cash in the locations? The response to one to question for you is alot more cutting-edge.

Borrowing to blow setting you might deploy considerable amounts from funding possibly in one go or higher a period of time. The interest, for those investing in public places-exchanged securities, can be tax-deductible. You to definitely chance are a financial investment made of lent money can get shed from inside the well worth, and this can be a reduced amount of a problem when it is a lengthy-label move. In addition, the cost of the mortgage over the years may become greater than the new money made from they.

Maiorino says traders looking to leverage the financing profile need to make certain this strategy match its complete financial desires, and you will endurance getting exposure.

Carried out in a great varied and you can mindful way, credit to expend is as valuable because investing a good home along side continuous, he says. In my opinion, it’s about the person and you may making certain the techniques is great issue to them.

According to a survey presented by Economist Cleverness Product (EIU), commissioned because of the RBC Money Management, 53 percent from buyers in the Canada say growing their wide range is a high financing strategy.

Brand new riches ascending survey aim highest-net-value some body (HNWIs), adult pupils regarding HNWIs, and you may highest-generating masters round the Canada, the fresh U.S., United kingdom, Asia, Hong-kong, Singapore and you will Taiwan. It appears to be on moving on landscaping off global riches, where wealth would be, just what it might be committed to, how it was spent and who is purchasing.

In Canada, 31 % of more youthful generations* say they obtain to expend, with 44 % preferring brings and you may forty two % preferring common money.

Doing early to construct riches

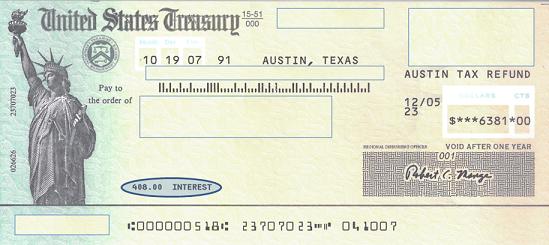

Borrowing to expend may start prior to some body has generated up a sizeable money portfolio, Maiorino claims. Such as, an investor in their 20s and you will 30s you’ll consider credit to donate to an authorized senior years offers package (RRSP) on a yearly basis. Deductible RRSP contributions can be used to eradicate personal income tax.

Investors can then explore the tax refund to repay a percentage of mortgage then, preferably, strive payday loan Gantt to pay others after in, Maiorino says. The procedure may then become regular to construct wide range.

If you possibly could afford they, and will make the payments, its a no-brainer, says Maiorino, who utilized this strategy earlier inside the community to cultivate their own investment profile.

The only thing you can’t get back is actually big date, Maiorino claims. For individuals who initiate advancing years coupons at twenty five, once you will be thirty-five, you will have a decade off financial investments, as well as people gathered growth. That is some thing somebody who begins paying on ages thirty-five is never probably enjoys.

Credit to grow their money

Just after an investor keeps a significant financing profile, they could desire to borrow against it to help you help grow their riches. Ann Bowman, head regarding Canadian Personal Financial on RBC Wealth Administration, says this can be an alternative better-suited to investors at ease with risk, along with a belief they might build a higher go back than the price of the mortgage.