Blogs

The fresh withholding agent need to prepare a questionnaire 8288-A concerning differing people of who tax has been withheld. If the dominating function of making an application for a withholding certification are to help you reduce paying along side withheld taxation, the new transferee would be at the mercy of focus and penalties. The eye and you will penalties might possibly be analyzed on the several months beginning for the twenty-first date after the date away from import and you can finish at the time the fresh percentage is created. To have partnerships getting rid of a great USRPI, the manner of reporting and paying along the tax withheld is the same as discussed earlier below Union Withholding to the ECTI.

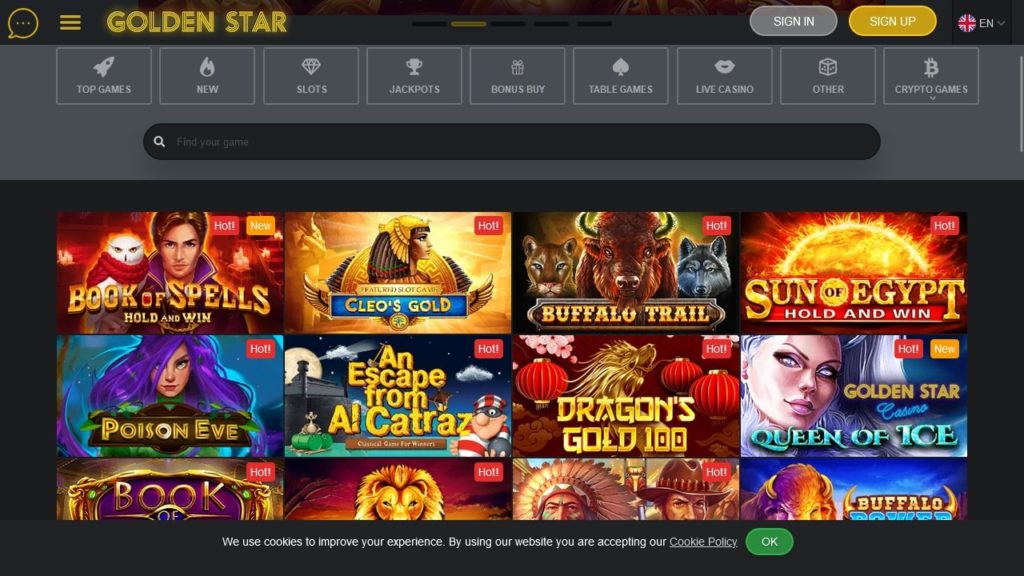

Currency exchange Administration Operate Notification – casino royal panda login

You ought to withhold to your terrible number subject to part step three withholding. We specialize in tenants insurance policies and you may retail time software open to owners thanks to designed partnerships. Although not, they’ll generally were; debt power to repay the borrowed funds, your level of personal debt, your credit score, as well as how you’ve used the bank account before. As well as an excellent 5% put, almost every other criteria implement – in addition to a living cover. Individuals need to meet with the specific credit criteria of your own using bank you select.

Name plans

A different partnership one to dumps a USRPI can get borrowing the new taxation withheld by transferee up against the tax accountability computed below the relationship withholding for the ECTI legislation. A shipment of a residential firm that’s a good You.S. real property holding company (USRPHC) is generally susceptible to chapter 3 withholding and you may withholding beneath the USRPI provisions. This also relates to a company that has been an excellent USRPHC in the any moment in the reduced of your own months when the new USRPI occured, or perhaps the 5-seasons several months finish on the go out out of mood. An excellent USRPHC is meet one another withholding terms whether it withholds lower than one of the pursuing the procedures. A good transferee could possibly get allege a refund to own a surplus count in the event the it’s been overwithheld up on under section 1446(f)(4).

Organization

- Provided differential attention will not be applicable to the deposit techniques presented using the Financial Name Deposit System, 2006 or perhaps the deposits acquired beneath the Financing Gains Profile Plan, 1988.

- The newest plan can not be used for second otherwise getaway family programs, buy-to-assist software or if perhaps the acquisition is to be regarding the term away from a small company (it ought to be within the private brands).

- For individuals who found a type W-8BEN-Age or Setting W-8IMY from a good nonreporting IGA FFI that is a good trustee-noted believe having a foreign trustee, you should have the GIIN away from a foreign trustee, however are not needed to ensure the new GIIN.

- The new modified amount know will depend on multiplying the total amount understood from the aggregate fee determined since the fresh commitment date.

- A residential partnership’s compliance with the laws and regulations satisfies the needs to own withholding for the mood away from You.S. real-estate hobbies (discussed afterwards).

Follow-right up actions need to be in place to offer the advice to the person personally at the casino royal panda login suitable date. (iv) In the event the an adult private is actually incapacitated at the time of admission which can be struggling to receive advice otherwise articulate whether or not he or she has conducted a keen progress directive, the newest business may give improve directive guidance to the individual’s citizen affiliate according to County law. (i) These types of requirements are conditions to inform and offer authored guidance in order to the mature citizens about the straight to take on or deny medical otherwise operation and you will, in the resident’s option, formulate an improve directive. (3) With the exception of information revealed in the paragraphs (g)(2) and you can (g)(11) associated with the part, the brand new business must ensure one to info is wanted to for every citizen in the an application and fashion the fresh resident have access to and you can understand, in addition to inside the an alternative style or even in a words that citizen can be discover.

The brand new Effect away from Get Now, Pay Later Your Mortgage Software.

Investing digitally is quick, simple, and you may reduced than just mailing in the a or money acquisition. Check out Internal revenue service.gov/Account to properly access information regarding the federal income tax membership. Next Internal revenue service YouTube channels offer brief, instructional videos on the some income tax-related subject areas inside English, Spanish, and you will ASL. A credit card applicatoin to have a great withholding certification not before described have to explain in more detail the newest recommended basis for the new issuance of your certificate and put forth the reason why justifying the new issuance away from a certificate thereon basis. The fresh Internal revenue service will be sending a page to your transferor requesting the new TIN and bringing tips based on how discover a great TIN. If the transferor contains the Internal revenue service that have a TIN, the brand new Irs can give the fresh transferor which have a stamped content B from Setting 8288-An excellent.

- Sadly, Florida rules just doesn’t allow the property manager to save all the desire.

- Payments to the organizations, but not, must be said for the Setting 1042-S if the fee is actually at the mercy of section step 3 withholding, whether or not no tax try withheld.

- Ukraine have dumps containing 22 away from 34 important nutrients recognized by europe as essential for energy protection.

- A non-Citizen Normal (NRO) account is a family savings which is beneficial for those who have income in the India.

Global Mediator Character Amounts (GIINs)

Gambling earnings that isn’t susceptible to part step 3 withholding are maybe not subject to reporting to your Mode 1042-S. The new Administrator otherwise their delegate will give the brand new alien that have a good page to you, the newest withholding agent, claiming the level of the very last payment out of settlement private characteristics that’s excused away from withholding, plus the amount who would if you don’t end up being withheld which may be paid back to the alien due to the different. The new alien need to give a couple copies of one’s page for your requirements and really should and mount a duplicate of your own letter on their taxation get back to your income tax 12 months in which the fresh exception is useful. The brand new fee of a qualified grant to an excellent nonresident alien are not reportable which can be not subject to withholding.

(c) The interest cost for the all the deposits, as well as in which differential interest levels are offered, might be subject to all round roof recommended in the 19 (g) below. (e) The main benefit of a lot more interest rate to your places on account of are lender’s individual group otherwise older persons will not be available to NRE and NRO dumps. Banking institutions should feel the independence to find the maturity/tenor of one’s deposit susceptible to the challenge you to minimum tenor of NRE label dumps will be one year which of NRO identity deposits will be seven days. (d) No punishment to possess untimely detachment is going to be levied, where depositors of your own department as stated inside area 4(h) associated with the advice wishes early withdrawal out of put subsequent on the transfer from organization to another bank. (b) Desire on the savings bank accounts, along with those people suspended by administration regulators, is going to be paid to the regular basis no matter what the brand new working status of your own account. (iii) When it comes to staff taken up deputation out of another financial, the financial institution from which he is deputed could possibly get ensure it is a lot more interest in respect of the offers or term deposit account open having it over the course of deputation.

The brand new laws of country X render that profile and you will resource of one’s earnings to A’s desire proprietors decided because if the funds was realized straight from the main cause you to definitely repaid they so you can A. Accordingly, A great try fiscally transparent within the legislation, country X. To possess reason for part step three, if one makes an installment to a good You.S. person and you’ve got actual education that U.S. person is finding the new payment since the a realtor away from a foreign individual, you ought to eliminate the fresh commission because the built to the fresh overseas individual. However, should your U.S. body’s a loan company, you may also eliminate the school because the payee considering you’ve got no reason to believe that the college will not adhere to a unique duty to help you withhold below section step 3. The fresh Irs usually stamp backup B and you may posting it for the people at the mercy of withholding.

To have details about so it exemption, come across Purchase Private Services Did, afterwards. In case your earnings is for personal services did from the Joined Says, it’s from You.S. supply. Where the support are carried out determines the main cause out of the cash, regardless of where the newest package was made, the place out of fee, or perhaps the home of your own payer. As well, a cost is actually at the mercy of chapter step three withholding if the withholding are particularly needed, although it may not make up You.S. source income or FDAP earnings. For example, corporate withdrawals could be at the mercy of chapter step 3 withholding even if part of the new distribution may be an income out of financing otherwise funding get that’s not FDAP income. A cost try at the mercy of section step 3 withholding in case it is of supply within the All of us, and is fixed otherwise determinable yearly or periodical (FDAP) money.

Останні коментарі