Of a lot People in the us don’t realize he’s victims of financing modification fraud up until its too late. With monetary filter systems on pandemic and you can an upcoming recession, aware people can protect on their own from losing prey so you can loan mod cons from the understanding how to determine new warning flags.

Listed here is a snippet away from what the feel you are going to incorporate. Your, also 164,580 most other Western homeowners, decrease about on the mortgage payments in the 1st 1 / 2 of 2022. You are aware you will soon receive the feared letter that your particular home loan servicer features id which be concerned, you get a phone call out of a telephone number. The individual on the other side line calls on their own an effective loan mod representative, as well as for some reason understand their home loan state. It show to not ever proper care and they will help. They claim that they can provide financing amendment. Actually, he or she is ensure that they can produce an easy one to. You’re not also yes what financing modification was. You do some investigating and you can discover that a mortgage amendment is a contract to change brand new regards to the financing, commonly employed by residents experiencing foreclosure.

The decision feels like a beacon out of guarantee. You’ve been providing frightening emails throughout the send, all of the from some other source which also in some way find out about your foreclosures. Some say he is entitled to repayments. Other people say to end while making mortgage money entirely. Specific even tell you straight to seek bankruptcy relief. This can be every daunting, and thus employing who you spoke to yesterday appears to be the most suitable choice. Their agency’s web site appears legitimate (it even possess testimonies!), until such time you have been in their well-adorned work place for a consultation. Afterwards you to few days, they supply several files so you can fill in along with your private information and sign. It charge initial charge. What they’re requesting is not cheaper, you are able to shell out all you are able if the it indicates keepin constantly your family. No less than he is letting you pay within the monthly payments. A part of you warrants the price, thinking that anything minimal to own such an elaborate process would be a scam. However, the fresh new swindle has took place. Did you catch one red flags?

Extremely telling would be the fact its illegal for loan modification companies to receive one percentage upfront. Charge getting helping having that loan amendment may only feel built-up pursuing the characteristics was in fact rendered. In reality, brand new York Attorney General’s Workplace prompts homeowners to help you statement such abuses. Second, banking institutions aren’t needed to grant some one a loan modification. A lender will get decline to offer a modification a variety of grounds, dependent on someone’s debt-to-income ratio or perhaps the sufficiency of their proof difficulty. Thus, the fresh guarantee you to a loan modification agencies can make is nothing more an blank hope.

Very, what direction to go? First, report this new scammer towards the Lawyer General’s office and stop their number. Next, homeowners is always to contact a beneficial U.S. Department of Houses and you can Metropolitan Advancement (HUD) accepted property guidance agency. There are non-earnings teams that provide loan modification advice as well as render ideas so you can lawyer. The fresh HUD web site instant same day payday loans online South Dakota lists such agencies of the county.

New Lawyers’ Committee’s National Loan modification Swindle Databases compiled data out of and you will showed that there were more than 42,000 foreclosures rescue fraud grievances and an impressive $98 mil out of losings to help you home owners

Keep in mind totally free help is available. The brand new stakes off undergoing foreclosure legal proceeding is actually highest, and is regular to feel anxiety about setting the near future of your home in the hands out-of a no cost otherwise sensible service. not, so it stress is precisely just what loan mod scammers is centering on. HUD-recognized firms offer their sense and expertise to assist find tailored possibilities to possess home owners. Which have assistance from a reputable institution otherwise lawyer, home owners does not only prevent mortgage loan modification frauds, but may along with renegotiate their mortgage loans and a lot more readily navigate brand new government Home Affordable Modification Program (HAMP). Actually, NeighborWorks The united states, a non-profit team chartered of the Congress, registered a great Congressional Revision of its loan-counseling system, appearing one residents that have guidance are practically 3 x probably be to get financing modification as compared to residents without counseling. Undergoing property foreclosure try an amazingly exhausting feel, so if one thing seems too-good to be real, they probably is.

Caroline Nagy & Michael Tanglis, That will You Believe? The brand new Property foreclosure Rescue Ripoff Crisis inside New york, sixteen (Matthew Hassett & Christie Peale eds., 2014).

:text=Scam%20artists%20offer%20to%20act,forward%20payments%20to%20your%20lender. Loan modification scammers often use public listings or information purchased from private companies to seek out their targets. Select id.

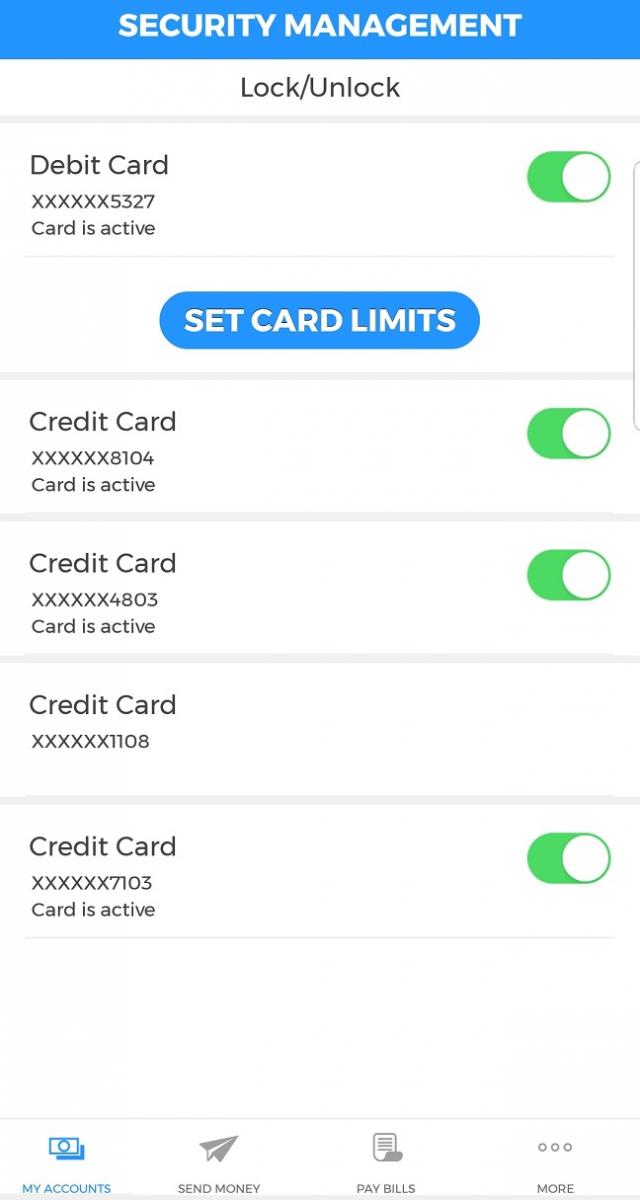

Third, there is no cause for that loan modification agencies to inquire of to suit your private monetary information-your own financial already provides everything it requires

See Erica Braudy, Taxation a lender, Save a house: Official, Legislative, and other Innovative Jobs to cease Foreclosure for the New york, 17 CUNY L. Rev. 309, 317 (2014).